Designing a Simpler Path to Early Financial Freedom

Lead UX Designer | Platform: Consumer Mobile App | Domain: Banking & Analytics

The part I played

My responsibilities included:

Key Challange

A Behavior-Driven Discovery Track

2. Design Discovery

People juggle multiple payment apps for “backup”

Users don’t trust a single system. They keep many apps and cards active just in case one fails. Trust, not tools, is the problem. Retire Early must feel reliable from day one.

Missing payment dates causes anxiety

People fear penalties more than debt itself.

Stress is driven by uncertainty, not lack of money.

Emergency Planning is rare

Financial thinking is reactive, not proactive. Progress needs to feel short-term and achievable, not distant.

Savings strategies are learnt from influencers, friends, and relatives

People follow “50-30-20” or random hacks without knowing if it fits their reality.Retire Early must translate personal data into personalised rules.

People don’t avoid finance because it’s hard they avoid it because it takes time. Micro-tasks under two minutes could keep them engaged.

Clarity beats knowledge

Users don’t want lessons; they want direction.

Turning data into one clear next step could drive action faster than education.

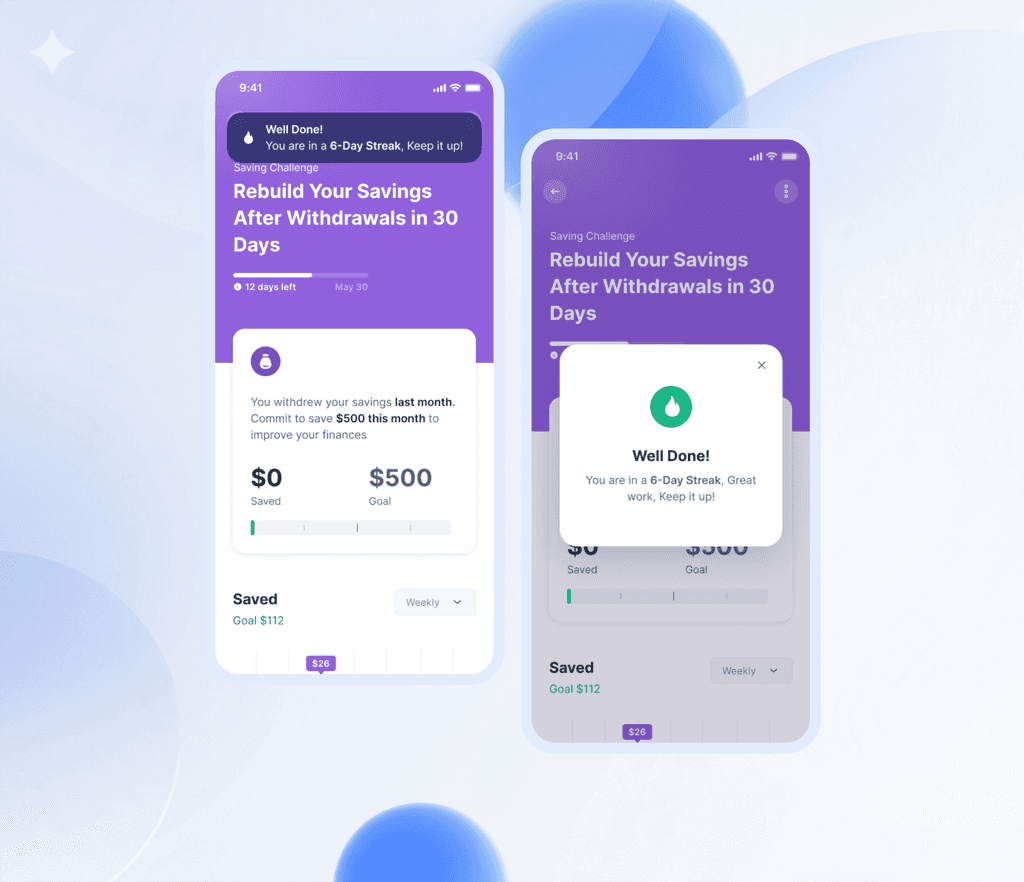

Tiny wins build habits

Motivation burns out, but progress compounds.

Small challenges and streak-driven rewards could build lasting behaviour.

Automation earns trust

Manual effort creates doubt and drop-offs. Transparent auto-categorisation and goal suggestions could reduce effort and strengthen confidence.

Spending is emotional

Money decisions happen in moods, not spreadsheets.

Right-time nudges could help users pause before impulsive spending.

Make Money Effortless

Autocategorization, one-tap goal setup, default savings suggestions, pre-filled actions. Let the app do the heavy lifting so saving feels automatic, not aspirational.

Teach Without Textbooks

Use bite-sized guidance in context quick tips during actions, spending insights with a “what this means” twist, and interactive challenges that teach by doing, not reading.

Turn Goals Into Daily Wins

The Retire Early Score becomes a progress meter, with streaks, micro-milestones, celebratory feedback, and savings “levels” that make long-term planning feel like leveling up, not waiting forever.

Replace Guilt With Smart Framing

Re-frame insights as wins: “Save ₹150 this week by swapping delivery twice.” Surfacing consequences as gains nudges users toward action without shame.

Develop

Designing a System Around Real People

This stage wasn’t about screens yet; it was about how the product should think. We first grounded the experience in real people, then shaped a system that supports the way they actually make decisions. Personas showed us how busy professionals handle money on the move, and the architecture translated those behaviours into a guided journey. Together, they set the rule for Retire Early: remove effort, remove uncertainty, and let progress happen in small, steady steps.

Once the product structure was defined, we shaped it around the people most likely to rely on it. Retire Early isn’t for finance experts it’s for busy professionals who want progress without extra learning or jargon.

The architecture only matters if it fits into real lives that are already packed and unpredictable.

Personas like John, a time-pressed electrician, and Sara, an office assistant juggling payments kept our decisions grounded. They don’t want financial theory; they want clarity and small wins they can actually maintain. Designing for their habits made the product direction obvious: reduce effort, remove uncertainty, and make saving feel doable one step at a time.

We mapped the product’s architecture first, not the UI. The goal wasn’t to arrange pages it was to turn saving into a guided system. Every connection in this map answers one question: what’s the next move for the user, and how do we make it effortless? Goals link to contributions, insights trigger actions, and challenges reinforce habits. By designing the system before the interface, we ensured Retire Early nudges progress by logic, not luck.

Deliver

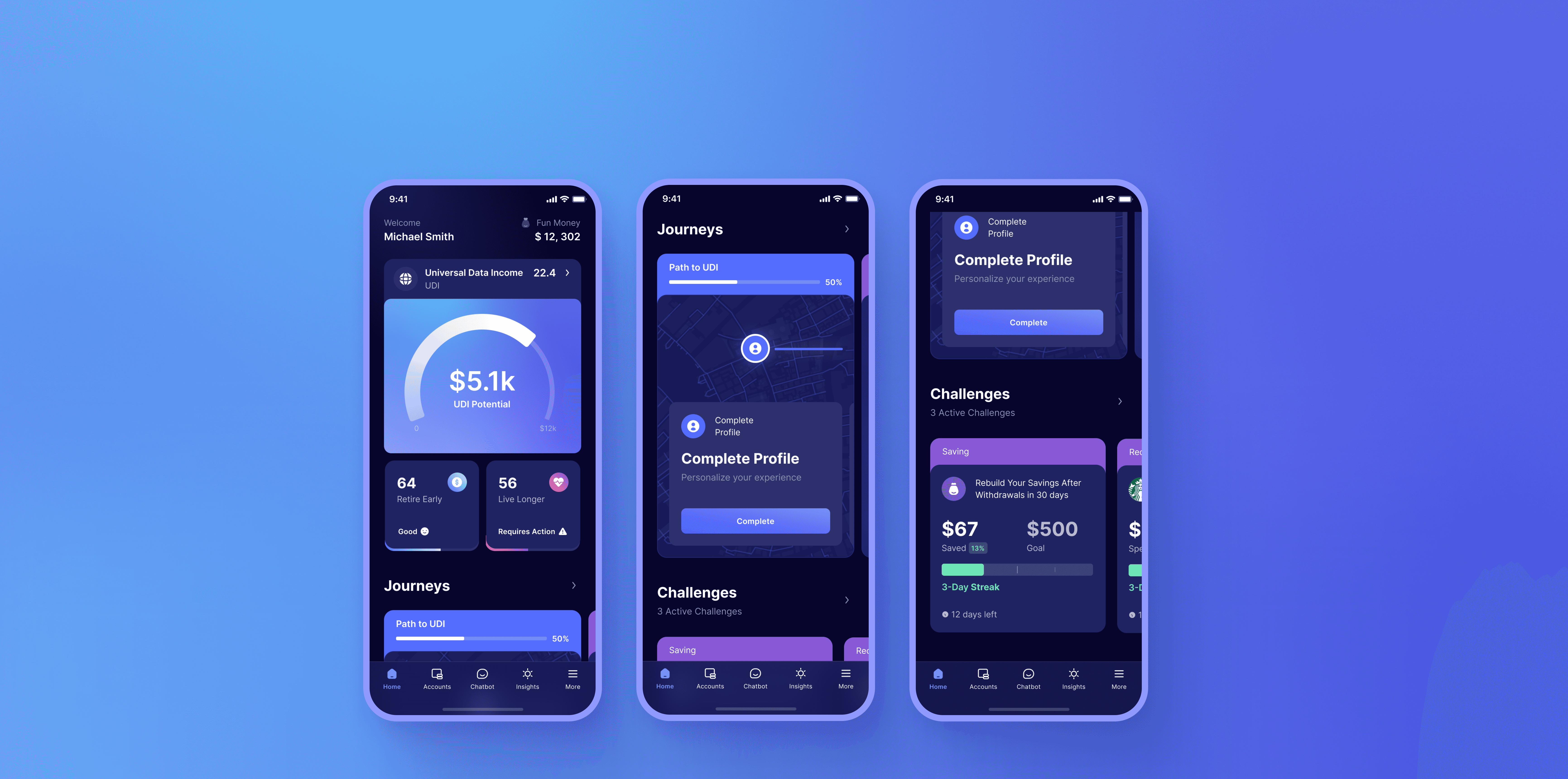

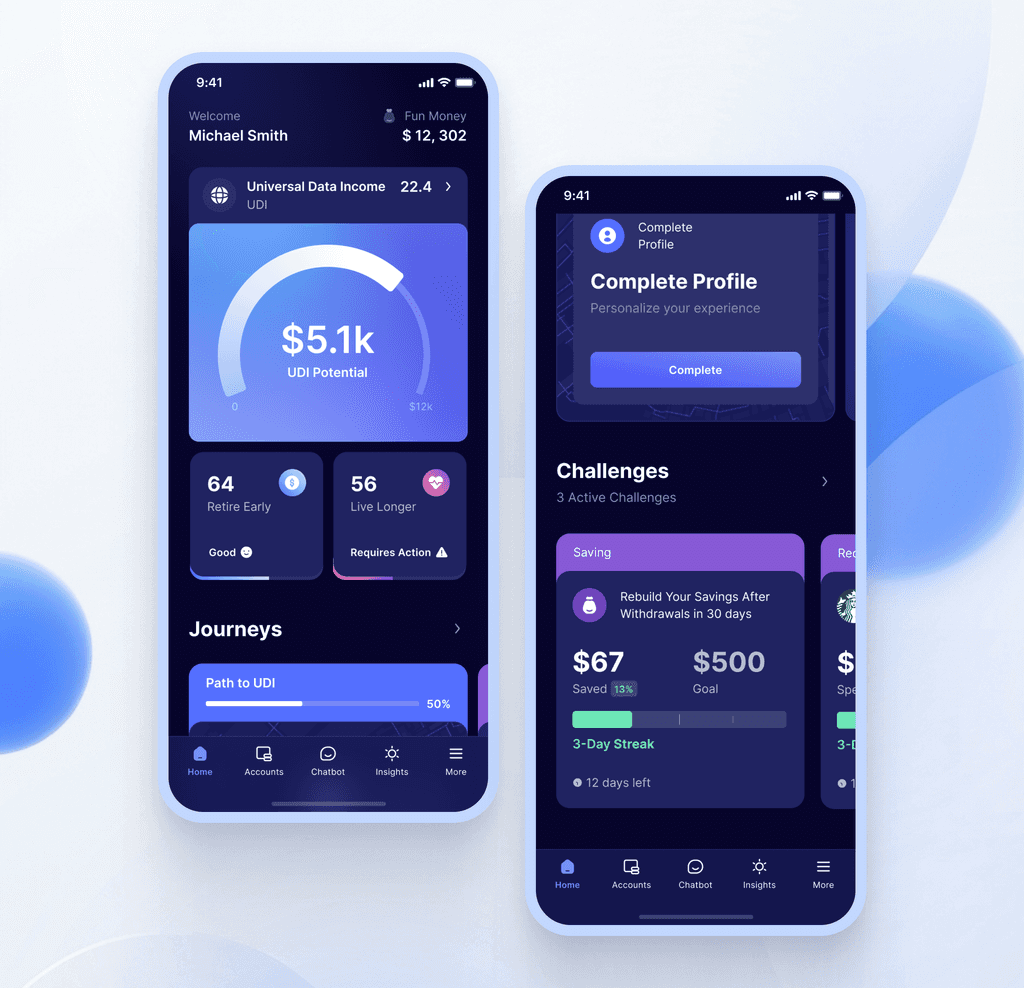

Designing a Life You Can Retire Into

Retire Early helps people work toward financial freedom without letting money take over their lives.

The experience focuses on clarity, momentum, and controlshowing users where they stand, what to do next, and how everyday decisions move them closer to retiring early.

Progress is designed to feel visible and rewarding, using gentle cues and small wins to keep users engaged over time.

The goal is simple: build consistency, reduce anxiety, and make long-term financial growth feel motivating not overwhelming.

Anti-Patterns Used

UX Psychology Applied

Results That Spoke for Themselves

Helped users move from financial confusion to clear next steps within minutes of onboarding

Increased weekly engagement through challenges, streaks, and progress feedback

Reduced anxiety around money by replacing complex planning with simple, guided actions

Improved saving consistency by turning long-term goals into short, repeatable habits

Strengthened trust in personal finances through transparent scores, previews, and progress indicators

Winning Moments

Proved that behavioral design can outperform traditional financial tools

Built a system where motivation and structure reinforce each other

Created a product users return to not because they have to but because it feels good to use

Lessons Learned

Clarity beats motivation — when the next step is obvious, users move without hesitation

Small wins build big change — micro-progress keeps long-term goals alive

Emotion matters in finance — calm design reduces fear and increases follow-through

Good UX doesn’t just inform — it reshapes financial behavior